Probate Pricing

We offer competitive fixed fee prices for clients wishing to complete Wills and Lasting Powers of Attorney with our experienced staff. By being able to offer fixed fee prices, Earl and Crocker are able to provide their clients with certainty and transparency so they know what they are paying from the outset. For probate matters, some firms charge a ‘value element’ with additional fees on top of the administration fees based on the value of the estate, however, we do not charge this at Earl and Crocker.

When it comes to providing Personal Representatives with assistance, Earl and Crocker have adopted a flexible approach and we will only provide you with legal work which you require.

As an example, some Personal Representatives prefer to leave the whole administration in the hands of trusted professionals and in these circumstances we take on the full administration. On the other hand, some Personal Representatives feel comfortable dealing with the administration of the estate but would like assistance with the Grant of Probate application and Inheritance Tax return.

VAT will be payable on our fees and some disbursements, currently 20%, and we will clearly confirm which disbursements carry VAT in our formal quotation or as we advise you to incur them.

If your matter becomes complex (see below) our fees may increase further and we will notify you in advance of any increased costs.

To give Personal Representatives a clear indication of costs, our fees are as follows: -

Grant of Probate Only Application

This is when the Personal Representatives have obtained the asset and liability valuations of the estate and they provide the figures to us. Earl and Crocker will then prepare the Inheritance Tax Form on their behalf and after this, apply to the HMCTS for the Grant of Probate.

This is a fixed fee service and our fees are: -

Non-taxable estate which requires the completion of an IHT205 tax form - £900 + VAT @ 20% (total £1,080)

Non-taxable estates which require the completion of an IHT400 tax form (e.g. applying for Residence Nil Rate Band Allowance) - £1,500 + VAT @ 20% (total £1,800)

Taxable estates from - £2,000 + VAT @ 20% (total £2,400) up to £3,500 + VAT @ 20% (total £4,200) depending on the complexity

How Long Will It Take

We will aim to prepare the Grant of Probate documentation within 2 – 3 weeks of receiving all the correct information. If there is no IHT400 form, then we will send the Grant of Probate application to the Court as soon as it has been signed. If an IHT400 has been completed, this will be sent to HMRC and after 20 working days, your application to the Court will be submitted. The Court can take up to 16 weeks to issue the Grant of Probate.

Key Stages: As Part of our fixed fee, we will:

Provide you with a dedicated and experienced probate lawyer to work on your matter,

Review the documentation that you provide to us,

Identify the legally appointed executors or administrators and beneficiaries,

Accurately identify the type of Probate application you will require,

Complete the Probate Application and the relevant HMRC forms on your behalf and send them to you for signing or sworn,

Make the application to the Probate Registry on your behalf,

Obtain the Probate and securely send the sealed copies to you,

We will not:

Please note, these instructions are limited to obtaining the Grant of probate or Letters of Administration and not dealing with any further work, such as collecting in the assets, paying liabilities and making distributions.

If after the Grant of Probate is received you instruct us to complete any further work, we will advise you of the costs separately.

Assisting a Personal Representative

When administering the whole of the estate, our services includes: -

Providing expert advice on the administration of the estate throughout

Contacting asset holders

Contacting debtors

Settling the funeral account

Ascertaining the value of the estate for inheritance tax

Preparation of the inheritance tax forms (whether an IHT205 or IHT400)

Obtaining a Grant of Probate

Releasing the bank accounts and holding the funds in client account

Settling the estate debts from funds received

Liaising with the beneficiaries, receiving their bank details and carrying out beneficiary checks

Preparation of the Estate Accounts

Obtaining approval of the estate accounts from the beneficiaries

Distribution of the estate

Sam or Steph will liaise with Personal Representatives as to whether we charge on a fixed fee basis or on an hourly rate. This is because clients like to have the flexibility to decide what service and assistance they require.

Sam’s hourly rate is £250 + VAT @ 20% (total £300)

Steph’s hourly rate is £200 + VAT @ 20% (total £240)

Lauren’s hourly rate is £175 + VAT @ 20% (total £210)

Any work carried out by our legal assistants Gemma or Veronica is charged at £80 + VAT @ 20% (total £96) per hour.

Our final fees will depend on the complexity of the administration of the estate and there are a number of factors which could include if there is any taxable element, if there is not a Will, the number of assets and liabilities, the number of beneficiaries, if there are any trusts, any potential claims which might be made against the estate, any unusual assets or foreign assets.

We can also instruct EstateSearch to carry out Asset Searches which helps the Personal Representatives ascertain the full estate and place S27 Trustee Act Notices to protect the Personal Representatives from any unknown creditors or claimants.

We can also assist Personal Representatives with obtaining unoccupied property insurance.

If Personal Representatives prefer a fixed fee quote this can be provided by Sam or Steph and this will be based on the complexity of the Will with our prices starting at £2,750 + VAT @ 20% (total £3,300). Usually, as an estimate, probate fees are usually between 1 – 2% of the gross value of the estate.

For example, if an estate comprises of a property, 3 bank accounts with 4 beneficiaries and a gross value of £350,000 our fees could be in the region of £3,500 + VAT @ 20% (total £4,200) and £4,500 + VAT @ 20% (total £5,400).

Our average fees assume that:

The transaction is concluded in a timely manner and no unforeseen complication arise.

All parties to the transaction are co-operative and there is no unreasonable delay from any parties providing documentation.

Conveyancing costs and any additional Deeds (e.g. Deed of Variation) is charged separately.

Each and every probate matter is different and so we cannot give a timescale as to when the matter will be completed. Straightforward estates can take 6 – 9 months to complete.

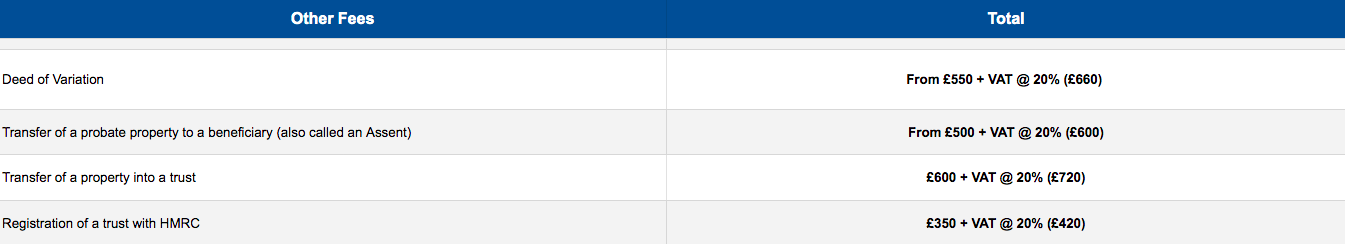

Other Fees which might be required during the course of administering an estate;

Disbursements usually required whether we apply for a Grant of Probate or deal with the whole administration of the estate are: -

Other disbursements which might be required during the administration of the estate include: -

It is not possible for us to anticipate all the disbursements which might be required and you will be advised of any other unanticipated fees.

We Will Not

Deal with the sale or transfer of any property in the estate – please see below*.

Please note that this firm does not deal with contested matters and if this should arise a Solicitor who specialises in such matters would need to be instructed and our file sent to them.

Potential additional costs

Unfortunately, it isn’t always possible for us to identify any issues that may increase your costs when you first instruct us to act for you. However, our many years of experience means that we know that if the following issues arise, they are likely to increase the legal fees payable and the time the matter will take: –

If there is no will or the estate consists of any share holdings (stocks and bonds) there is likely to be additional costs that could range significantly depending on the estate and how it is to be dealt with. We can give you a more accurate quote once we have more information,

Where there is property abroad,

Where there are existing trusts

Where there is Inheritance Tax (IHT) to pay**

Where the beneficiaries require incidental advice such as varying the terms of the Will for IHT purposes,

If there are multiple beneficiaries, properties and multiple bank accounts

An investigation by the Department of Work and Pensions,

Where there is a business interest,

Where we are required to carry out regular inspections of a property,

Where there are numerous beneficiaries or beneficiaries that cannot easily be traced,

Where there are many bank and/or building society accounts,

Where a claim is intimated or brought against the estate,

Where the executors cannot work together and agree their instructions to us.

Not having all of the paperwork available, or having missing or incorrect information that needs investigation and correction

Having to arrange valuations of assets

Third parties not responding to our communications promptly

Dealing with unusual or complex assets or items i.e. fine art, timeshares, shares in private companies etc.

*Additional charges will be incurred if there is a property to transfer or dispose of. We will be happy to offer a fixed fee for any conveyancing transaction.

Estates over £325,000 may be subject to Inheritance Tax at the prevailing rates. **To help you decide whether any Inheritance Tax is likely to be due or not, you can visit: https://www.gov.uk/valuing-estate-of-someone-who-died/estimate-estate-value

As soon as any complications arise we will discuss these with you and agree the fee for the additional work being carried out in advance of any additional work being undertaken.

Our Probate Team

image coming soon

“Please thank all your staff for the excellent service received!”

〰️

“It became a complicated purchase but you guided us through it and we felt confident”

〰️

“Please thank all your staff for the excellent service received!” 〰️ “It became a complicated purchase but you guided us through it and we felt confident” 〰️